Dedicated vs. General-Purpose Electrical Outlets in Cost Segregation

Feb 12, 2026One of the most common questions in a cost segregation study is whether certain electrical outlets qualify as part of the building or as equipment-related electrical that may receive a shorter recovery period. The distinction usually comes down to whether an outlet is considered general-purpose or dedicated.

The IRS Cost Segregation Audit Technique Guide (ATG) explains that this is not about what happens to be plugged into an outlet today. Instead, it focuses on why the outlet and its related wiring were installed in the first place and how they function within the building.

What Are General-Purpose Electrical Outlets?

General-purpose, sometimes called convenience outlets, are electrical outlets that serve the normal operation or maintenance of the building. These outlets are broadly accessible and usable for typical building needs rather than tied to a specific piece of equipment.

The ATG treats these outlets as part of the building’s electrical system. Examples include outlets in break rooms, common areas, offices, and lounges, as well as standard wall outlets used for everyday items like computers, printers, copy machines, or other office equipment.

A key point emphasized in the guidance is that plugging equipment into an outlet does not make the outlet special. Just because a copier, treadmill, or other item is using an outlet does not mean the outlet was installed specifically for that purpose. If the outlet is generally available for normal building use, it is typically treated as building electrical.

What Are Dedicated (Special) Electrical Outlets?

Dedicated electrical outlets are different because they are necessary to and used directly with a specific piece of machinery or equipment. These outlets, along with their associated wiring, conduit, and circuit breakers, are installed specifically to serve that equipment.

The ATG describes these as special electrical connections that link particular equipment to the electrical distribution system. Common examples include dedicated electrical service for equipment such as vehicle lifts, service bay equipment, paint booths, car washes, or other machinery that requires a specific electrical setup.

In these cases, the electrical components exist because the equipment exists. Without that specific equipment, the outlet and branch circuit would not typically be installed.

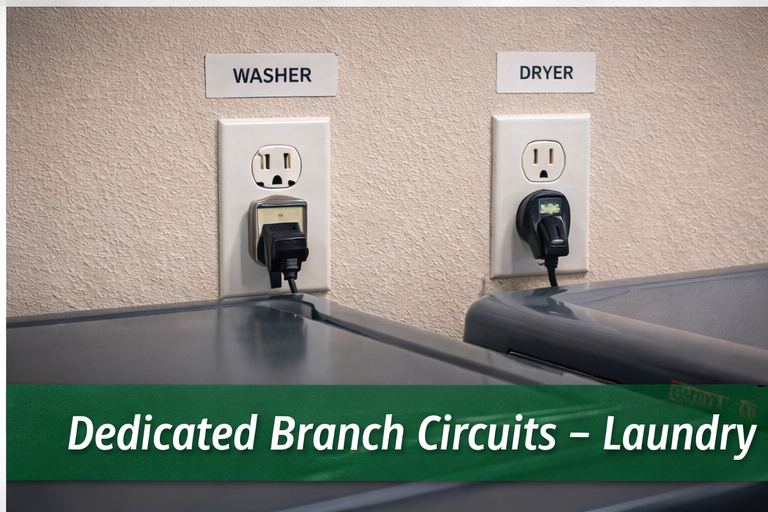

Practical Examples in Residential Rental Properties

In residential rental properties, kitchens and laundry areas often illustrate this distinction clearly.

General wiring, outlets, and switches in a kitchen are usually treated as building electrical. However, dedicated branch circuits serving specific appliances are treated differently. For example, wiring and outlets installed specifically for an electric range, dishwasher, refrigerator, built-in microwave, washer, or dryer are typically considered dedicated electrical.

The ATG’s discussion of “Electrical Branch Circuits – Appliances” highlights this distinction. It references 220-volt wiring and outlets dedicated to electric ranges or dryers, as well as 110-volt outlets dedicated to washers, dishwashers, refrigerators, and built-in microwaves. These examples explicitly exclude outlets of general applicability and accessibility.

Why Placement and Design Matter

Court cases and IRS guidance reinforce that context matters. In the AmeriSouth analysis, outlets that were simply available for general use, such as countertop outlets or outlets a treadmill or copier might plug into, were treated as structural components of the building.

By contrast, outlets that were clearly placed for a specific appliance were treated differently. Examples included a kitchen duplex outlet positioned specifically to serve a refrigerator, 220-volt outlets used solely for stoves, and laundry outlets clearly intended for washers and dryers.

The takeaway is that outlet location, voltage, design, and exclusivity all help demonstrate whether the electrical was installed for a specific piece of equipment or for general building use.

Why This Distinction Matters in a Cost Segregation Study

The difference between general-purpose and dedicated electrical directly affects how assets are classified for depreciation. General-purpose electrical is typically treated as part of the building. Dedicated electrical associated with specific equipment may qualify for shorter recovery periods when properly identified and documented.

This is why cost segregation relies on facts, design intent, and supporting documentation rather than assumptions based on current use. The ATG makes clear that classifications should be based on how and why the electrical components were installed, not simply what happens to be plugged in.

Key Takeaways

• General-purpose outlets serve normal building operation and maintenance

• Plugging equipment into an outlet does not make it dedicated

• Dedicated outlets are installed specifically for particular equipment

• Voltage, placement, and exclusivity help establish intent

• IRS guidance focuses on function and design, not convenience

Do you have a question about Cost Segregation?

Let us know how we can help

We hate SPAM. We will never sell your information, for any reason.